Downloadable version of the AAVR can be found here:

1. General venue accounting conditions

1.1 Adherence to accounting and auditing venue requirements

These accounting and auditing venue requirements have been determined by the Victorian Gambling and Casino Control Commission (Commission) under section 10.1.5C of the Gambling Regulation Act 2003 (the Act)(opens in a new window).

Section 3.4.1B of the Act requires a venue operator to comply with an operational requirement determined by the Commission unless the Commission has, in writing, given its approval to the venue operator not to comply with the standard or operational requirement.

The Commission will conduct regular reviews of a gaming venue to assess a venue operator’s adherence to the requirements. Disciplinary action may be taken against a venue operator for failing to adhere to any of these requirements.

Failure of a venue operator to comply with these requirements is grounds for disciplinary action under section 3.4.25 (1) of the Act. Disciplinary action under section 3.4.25 (1) could result in:

- cancellation or suspension of the venue operator licence

- variation of the conditions of the venue operator licence

- issuing a letter of censure to the venue operator

- a fine not exceeding 5000 times the value of a penalty unit.

In addition to the requirements in this document, a venue operator should also consider obligations from other regulatory/statutory bodies, including the:

- Australian Transaction Reports and Analysis Centre, and

- the Australian Taxation Office.

1.2 Accurate record keeping

Section 3.7.4 of the Act requires a venue operator to keep accounting records:

- that correctly record and explain the transactions and financial position of operations of the operator

- in the form required by the Commission and in a manner that will enable:

- true and fair financial statements and accounts to be prepared from time to time; and

- in the case of a club venue operator, true and fair community benefit statements to be prepared under section 3.6.9 and for those financial statements, accounts and community benefit statements to be conveniently and properly audited.

1.3 Gaming data reconciliations

A venue operator must perform reconciliations of gaming transactions to attest to the completeness and accuracy of gaming data reported by the monitoring licensee.

Further information is provided in section 2 of these requirements on the minimum standard of reconciliations required by the Commission and the source documentation that must be maintained by venue operators.

A venue operator is not limited to the reconciliations outlined in these requirements and may instigate further reconciliations as it deems necessary.

1.4 Contracting of third-party service providers

A venue operator may contract the services of a third party or use third party management systems to provide gambling related services. This includes Ticket-In Ticket-Out (TITO), Card Based Cashless (CBC), financial management system and loyalty system providers.

Third party systems may not require approval by the Commission and therefore have not been assessed to ensure they adequately assist venues in offering gambling related services or assisting in adhering to these or any other requirements. Therefore, it is the responsibility of the venue operator, and not the service provider, to ensure that these requirements, and any other requirements have been adhered to.

All required source documentation must be maintained by the venue operator in accordance with section 1.6 of these requirements.

1.5 Record keeping systems

A venue operator must maintain a system of record keeping, preferably in electronic format, which can be conveniently and adequately audited by the Commission.

All source documents to support adherence to these requirements must be readily available to the Commission.

1.6 Maintaining gaming records

Section 3.7.5 of the Act requires an operator to ensure that all documents relating to the operations of the gaming venue/operator are:

- kept at the approved venue, in the case of a venue operator

- retained for not less than 7 years after the completion of the transactions to which they relate.

Note that from 1 July 2008 the Commission granted an exemption to venue operators from the requirement to keep documents for 7 years. The period of retention was reduced for the majority of the gaming records to 3 years and audit rolls are to be kept for 13 months.

1.7 Maintenance of separate gaming bank accounts

Any bank account/s used to process gaming machine transactions must not be used to account for other business-related transactions.

Section 3.7.3 (1) of the Act requires that a venue operator must:

- keep and maintain separate accounts, as approved by the Commission, at an authorised deposit-taking institution in the State for use for all banking transactions arising under this chapter in relation to the operator

- from time to time provide the Commission, as required, and in a form approved by the Commission, with a written authority addressed to the authorised deposit-taking institution referred to in paragraph (a) authorising that institution to comply with any requirements of an inspector exercising powers under this section.

Examples of gaming machine transactions arising under chapter 3 of the Act, that must be processed through separate gaming accounts include, but are not limited to:

- depositing of all gaming revenue (section 3.1.4)

- payment of large wins, accumulated credits or jackpot prizes (section 3.5.33)

- accounting for movements to and from jackpot arrangements (section 3.4.1B)

- payment of penalty interest as determined by the Commission (section 3.6.10)

- entitlement payments (section 3.4A.11)

- payment of the supervision charge as determined by the Commission (section 3.6.5A)

- sweep of monthly gaming taxes by the Commission (section 3.6.6C).

Gaming machine transactions that must not be processed through any of the accounts used for transactions arising under chapter 3 of the Act include, but are not limited to:

- payment of any monitoring and maintenance fees to the monitoring licensee

- payment of related fees to third party service providers

- gaming machine purchase or lease payments

- payments to other government bodies that are not covered in this document (e.g., payment to Australian Taxation Office)

- any other payments in relation to non-gaming activities.

1.8 Registration of nominated bank account for sweeping of gaming tax by the Commission

To facilitate a complete and accurate collection of gaming taxes, the Commission will instigate a direct sweep of taxes owing from a venue(s) nominated bank account at the conclusion of the month.

For this process to occur a venue operator must submit details of their nominated bank account by completing a Direct Debit Authority (DDA) with the Commission. The DDA application process is available to venue operators via their secure login access to the Commission’s Online Services Portal(opens in a new window).

An individual venue operator must submit an individual DDA for each of its operating venues.

If more than one gaming venue is owned by an entity, the venue operator may wish to consolidate the collection of taxes from one nominated gaming bank account. However, this account must only be used for gaming transactions arising under Chapter 3 of the Act, as detailed in section 1.7 of these requirements.

For further details regarding this process please access the Online Services Portal(opens in a new window).

1.9 Change in gaming venue operator

Upon a change of venue operator at an approved gaming premises, both the outgoing and incoming venue operator must perform all the necessary data recording, reporting and reconciliations, outlined in these requirements and applicable legislation, to ensure effective handover of the venue.

Transitional functions must include, but are not limited to, the following:

- recording all soft meters at the conclusion/commencement of the operation period

- performing all gaming reconciliations at the conclusion/commencement of the operation period

- conducting money (coin and note) clearances and required cash handling activities

- providing and/or maintaining accurate banking details in the Direct Debit Authority submitted to the Commission to ensure the required tax obligation apportioned to each owner can be collected

- account for unpaid jackpot prizes and unclaimed gaming machine tickets as required

- ensuring all gaming machine meter exceptions have been cleared to allow for complete and accurate calculation of gaming taxes. Refer to section 2.2.ii of these requirements for further information regarding gaming machine meter exceptions

- if applicable, making suitable arrangements to account for monies held in cashless accounts. This may include the reimbursement of funds to patrons, where possible, or the transfer of funds to cashless wallets held by the new venue operator.

Accounting for unclaimed/unpaid prizes and funds in cashless wallets

Upon changing the venue operator of a gaming venue, any associated liabilities regarding outstanding tickets and unclaimed monies/tickets must be accounted for, and unpaid jackpot prizes settled in line with the requirements under section 3.5.45 and 3.5.46 of the Act. This should include:

- accounting for all tickets issued from gaming machines, Cash Redemption Terminals (CRT) or operator terminals, and monies in cashless wallets, as part of the settlement process, that must be honoured by the new venue operator

- accounting for any outstanding liabilities for unclaimed prizes that must be remitted to the relevant collection agency, by the outgoing owner, at time of settlement.

Accounting for jackpots that have not been paid out

Dealing with transfer of unpaid jackpot funds on transfer of approved venue

Section 3.5.45 of the Act states that:

- Immediately prior to the transfer of an approved venue from one venue operator (venue operator A) to another venue operator (venue operator B), venue operator A may transfer any unpaid jackpot funds in relation to a linked jackpot arrangement operated at the approved venue to venue operator B.

- At least 48 hours before transferring unpaid jackpot funds under subsection (1), venue operator A must give the Commission written notice —

- in the form approved by the Commission; and

- containing the information required by the Commission.

- Immediately after transfer of the approved venue, venue operator B must allocate the funds transferred under subsection (1) to a special prize pool in relation to a linked jackpot arrangement operated at the approved venue.

Dealing with unpaid jackpot funds where venue operator ceases to hold licence or to operate gaming machines

Section 3.5.46 of the Act states that:

- This section applies if a linked jackpot arrangement is retired because a person —

- ceases to hold a venue operator’s licence; or

- ceases to hold gaming machine entitlements to conduct gaming at an approved venue.

- The person must, within 28 days, pay to the Commission for payment into the Responsible Gambling Fund any unpaid jackpot funds in relation to the linked jackpot arrangement less an amount transferred to another venue operator under section 3.5.45 (1) (if any).

For the purpose of section 3.5.46 of the Act, the value of unpaid jackpot funds at the cessation of the venue operator’s licence or the holding of gaming machine entitlements must be paid to the Commission for further payment into the Responsible Gambling Fund (RGF) within 28 days.

In the event that part of the unpaid jackpot funds has been transferred to another venue operator under section 3.5.45(1) of the Act, the amount due to be paid equals total unpaid jackpot funds less the amount transferred to another venue operator.

Dealing with jackpots retired before 10 March 2023

Section 3.5.47 of the Act states that:

- If a venue operator retired a linked jackpot arrangement before the commencement of this Division —

- the venue operator may, within 12 months after that commencement, allocate the balance (whether in surplus or deficit) of the jackpot special prize pool in relation to that arrangement to the jackpot special prize pool in relation to another linked jackpot arrangement operating in the approved venue; and

- within 7 days after the end of the period referred to in paragraph (a), the venue operator must pay any remaining unpaid jackpot funds in relation to the retired linked jackpot arrangement to the Commission for payment into the Responsible Gambling Fund.

- This section does not apply in relation to a linked jackpot arrangement that was retired before 16 August 2012.

If a change of ownership occurs prior to 10 March 2024, and the requirements pursuant to section 3.5.47 have not been actioned, a venue operator must:

- liaise with the monitoring licensee to allocate the Jackpot Special Prize Pool (JSPP) balance to the JSPP in relation to another linked jackpot arrangement (LJA) operating in the approved venue before the change of ownership, or

- within 28 days, pay to the Commission for payment into the RGF any unpaid jackpot funds in relation to the LJAs retired before 10 March 2023 less the JSPP balance allocated, and

- at least 48 hours before the change of ownership, the outgoing venue operator must give the Commission written notice, in the form approved by the Commission and containing the information required by the Commission, on the treatment of the unpaid jackpot funds related to the LJAs retired before 10 March 2023.

The Commission will provide instructions in relation to the written notice for transfer of unpaid jackpot funds, when the outgoing venue applies for removal of approved premises.

2. Gaming reconciliation requirements

2.1 Electronic gaming machine data recording and reporting

Soft meter recording

Soft meters represent electronically recorded gross meters, stored within a gaming machine, which also increment proportionally to the level of gaming activity conducted on the machine.

Soft meter readings must be independently recorded/verified by the venue from each gaming machine on a daily basis to allow for the reconciliation of daily polled data received from the monitoring licensee.

At a minimum, the following soft meter readings must be recorded:

- Credits played/turnover

- Credits won

- Total cash in

- Total cash out

A venue operator may use electronically available gross soft meters to meet this requirement however these meters must be independently and physically verified with the meters in each gaming machine on a daily basis prior to the commencement of the next day’s gaming trade.

The venue operator must maintain daily evidence of the verification performed, including a hard copy of the electronic soft meter readings used and signatory verification on this required source document.

A venue must retain evidence of investigating and rectifying any discrepancies detected during reconciliation of soft meters and polled data. Evidence may include, but is not limited to, file notes of discussions with key stakeholders such as the monitoring licensee/technicians, screen shots of physical machine meters, etc.

Any variances that have not been adequately investigated by a venue may result in disciplinary action for failure to comply with these requirements.

Time to record soft meters

All meters must be recorded at the conclusion of gaming at the venue. The gaming venue must be closed to gaming patrons and all machines must be vacated before commencing the recording process.

When recording meters on the morning prior to the day’s gaming, meters must, where possible, be recorded after the daily polling time and prior to the commencement of trade on the day.

Where trading continues past the daily polling time, the meters should be recorded at a consistent time across each day.

Large payouts/cheque register

Section 3.5.33 of the Act requires that:

If a person has $2000 or more worth of accumulated credits on a gaming machine, the venue operator or gaming operator must not pay out, or allow another person to pay out, any of those credits except in accordance with subsection (2) or (3).

Penalty: 60 penalty units.

A venue operator or gaming operator must, at the request of a person, pay out any accumulated credits from a gaming machine to the person by cheque that is not payable to cash.

Penalty: 60 penalty units.

A venue operator must, at the request of a person:

- pay out any accumulated credits from a gaming machine to the person by electronic funds transfer

- if at least $2,000 is to be transferred, transfer those funds in a way that means they are not available to the person for 24 hours after the transfer.

Penalty: 60 penalty units.

Subsection (3) does not apply to a venue operator who does not have the facilities to make the electronic funds transfer described in that subsection.

The Monitoring Licensee will provide a system based ‘Centralised Cheque/EFT Register’ (CCR) to record and store all relevant information relating to all payments of gaming machine winnings made via cheque or EFT (regardless of the amount).

Venue operators must use the CCR to record all cheque or EFT payments made to patrons for gaming machine wins in a timely manner.

At a minimum, the CCR should be updated at the end of each gaming day to record all payments and transfer made on that day.

A venue operator must ensure all necessary steps are taken to capture accurate and complete information in the CCR.

All required information in the CCR must be populated.

Venue operators may retain supporting documentation where necessary to support the issuance of cheque or EFT payments, including:

- copies of patron identification (e.g. driver licence or passport), with corresponding cheque number and/or EFT reference number written on the copy.

- copies of any other documentation deemed necessary by the venue to support the payment, such as tickets.

Venue operator must ensure patrons are advised of the following:

- information collected in relation to cheque or EFT payments for gaming machine wins will be stored in the CCR; and

- this information may be accessed by the Commission for regulatory purposes and may be disclosed to law enforcement or other regulatory bodies if required.

The notification to patrons may be provided verbally, or by displaying a notice at the location where the payments are issued (e.g. venue cashier). The display of a notice is encouraged to evidence compliance with this requirement.

2.2 Data analysis and adjustments

Ensuring the accuracy of reported gaming data

The venue operator must ensure the accuracy and completeness of polled financial data reported by the monitoring licensee in relation to gaming machines at the venue.

A venue operator must perform all of the necessary reconciliations and data analysis as identified in these requirements to ensure the accuracy of reported data.

Any significant concerns regarding unexplained variances in a venue’s analysis of polled financial data should be addressed with the monitoring licensee, and evidence of such a process be retained by the venue in relation to each matter.

Analysis of gaming machine meter exceptions

To ensure the accuracy, integrity and completeness of taxable revenue at the conclusion of the month, the monitoring licensee will identify gaming machine meter exceptions that must be reviewed and cleared by the venue operator in a timely manner. Gaming machine meter exceptions include, but are not limited to:

- meter rollover: machines where meters have declined in relation to the previous game date, i.e., a master reset

- runaway meters: machines where meters have reported excessive or irregular increment levels, i.e., excessive metered information

- abnormal meter increments: data reported exceeds a predefined limit.

To facilitate timely and accurate collection of taxes, the venue operator must review all gaming machine meter exceptions and process necessary adjustments before the end of the second day after the conclusion of the calendar month to which the tax relates.

Any adjustments processed after the second day concluding the end of the taxable month will not be included in the tax calculation and may result in a penalty interest charge due and payable by the venue operator.

It is a venue operator’s responsibility to ensure they are familiar with the process for clearing gaming machine exceptions and raising necessary financial adjustments. A venue operator should consult with the monitoring licensee to ensure it has a detailed understanding of the process required to clear machine exceptions.

The Commission will be responsible for reviewing and acknowledging all gaming machine adjustments before the adjustments are included in the taxable revenue for the period.

If the Commission does not acknowledge an adjustment prior to the end of the second day concluding the end of the taxable month, it is the venue operator’s responsibility to ascertain why the adjustment was not acknowledged and re-adjust as required.

Appropriate documentation must be maintained by the venue operator in relation to any analysis conducted into machine exceptions and adjustments raised.

Supporting documentation may be requested by the Commission as part of the adjustment assessment process and must be readily accessible for all adjustments requiring validation.

Outstanding gaming machine exceptions at the end of the month

Failure to correctly process a gaming machine adjustment in relation to a reported machine meter exception will result in the taxable revenue for the machine on the affected game day, being excluded from the calculation of gaming revenue.

As a result, failure to review and correct all necessary meter exceptions within the month that they occur will result in penalty interest for the late payment of taxes as and when they are due.

Unscheduled master resets

An unscheduled master reset is a reset that has not been scheduled with the monitoring licensee, usually as a result of a gaming machine malfunction. The venue operator must ensure that unscheduled resets are, where possible, kept to a minimum and correct procedures are followed by notifying the monitoring licensee of all master resets performed.

The monitoring licensee will provide a venue operator with the necessary steps required to ensure all gaming data is polled by the monitoring system prior to the conduct of any unscheduled master resets. These steps must be adhered to by the venue operator prior to the conduct of any unscheduled resets.

A venue operator must assess all unscheduled master resets performed to ensure no missing trade has occurred and documentation must be maintained providing details of all resets conducted.

A venue operator must, prior to conducting a master reset on the gaming machine, as part of the cash collection process, record all available meters for financial and audit purposes.

Monitoring of tickets issued by gaming machines

Any reference to ‘tickets’ in this document includes Ticket-In Ticket-Out (TITO) tickets issued by the TITO system as well as hand pay tickets issued by the monitoring system. Ticket reports are generated by the relevant system that produces the ticket.

Venue operators must have procedures in place to monitor all tickets issued by gaming machines against all tickets redeemed and subsequently paid by the venue.

On a daily basis, the venue operator must review the status of all tickets issued the previous trading day, together with the reports issued by the relevant system, in order to ensure that all tickets paid have been correctly redeemed at the time

This will ensure that a complete and accurate list of unclaimed tickets is maintained on the monitoring system (in the case of relevant hand pay tickets) and on the TITO system (in the case of TITO tickets) and will help a venue operator to meet its obligations in relation to the reconciliation of tickets issued and redeemed.

A venue operator must not clear or attempt to redeem any tickets off the monitoring system or the TITO system unless it has a ticket which has been received from and paid to a gaming patron.

Unclaimed prizes/winnings

A venue operator will be liable to pay the State Revenue Office (SRO) the value of unclaimed winnings that have been issued by gaming machines, which have not been redeemed within the defined period.

Section 3.6.13 of the Act, requires that ‘on or before 31 May each year a venue operator that held winnings on 1 March of that year that had remained unclaimed for not less than 12 months before 1 March must pay to the Treasurer an amount equal to the sum of all those unclaimed winnings less any amounts that have been paid to persons entitled to the winnings and any amounts deducted under subsection 2’.

In this section winnings mean winnings from the playing of a gaming machine, including winnings in the form of:

- a cheque

- a ticket or other instrument authorising the payment of winnings from the playing of a gaming machine (includes TITO tickets, hand pay tickets and any other voucher printed by a gaming machine)

- accumulated credits (including accumulated credits which have been downloaded from a gaming machine onto a player card/cashless wallet that has remained inactive)

- any coins left in the coin tray of a gaming machine.

A venue operator must maintain a register of unpresented cheques, accumulated credits and any coins left in the coin tray of a gaming machine, to substantiate payments of such amounts to the SRO in line with the conditions outlined in the Act.

The monitoring system will provide venue operators with details regarding the status of hand pay tickets issued by gaming machines at their venue, and the TITO system will provide venue operators with details regarding the status of TITO tickets issued by gaming machines and/or a Credit Redemption Terminal. The venue operator is responsible for the assessment of the unclaimed ticket reports provided by the monitoring system and the TITO system and determining a complete and accurate declaration of unclaimed tickets to the SRO.

Any patrons seeking payment for tickets that have been remitted as unclaimed winnings should be directed to the SRO for payment.

A venue operator must maintain records to substantiate the yearly reconciliation of unclaimed winnings and amount paid to the SRO. The details must include, but are not limited to:

- reports produced from the monitoring system and the TITO system showing expired tickets for the relevant period. This should act as the base for a venue operator to determine its obligations in relation to unclaimed monies

- where the venue has changed ownership during the abovementioned period, and subject to the contractual arrangements between the parties passing on responsibility for unclaimed tickets, details of unclaimed winnings and monies supplied by the previous venue operator

- supporting documents to validate any tickets/hand pays that appear on the monitoring system or the TITO system that the venue deems as having been paid but unredeemed. Documents must include a copy of the ticket/hand pay voucher, payout details, proof that the ticket is a duplicate or invalid ticket, etc.

- a register of unpresented cheques, accumulated credits or coins left in the machines that must be remitted as unclaimed

- details of expenses claimed under section 3.6.13 (2)

- reports produced from the card-based cashless system, showing cashless wallets/cards that have been inactive for the required period, detailing unclaimed money (see section below) and unclaimed winnings.

In the Commission’s assessment of amounts remitted in relation to unclaimed prizes, an assessment will be made as to expenses incurred in searching for persons entitled to the winnings, if claimed by the venue operator. Section 3.6.13 (2) of the Act allows for venue operators to deduct out of unclaimed monies the expenses reasonably incurred in searching for the persons entitled to the winnings.

All reasonable expenses claimed by the venue operator in relation to searching for the persons entitled to unclaimed winnings must be justified and should not be applied based on the value of each unclaimed ticket. It is expected that reasonable expenses would include, but are not limited to, bank fees, stationery and postage incurred in searching for the persons entitled to the winnings. Expenses do not include those incurred in managing unclaimed tickets.

Unclaimed money

Venue operators must also adhere to unclaimed money requirements under the Unclaimed Money Act 2008(opens in a new window), and note, in particular:

- the definition of unclaimed money, and the differing definitions of unclaimed monies and winnings

- the responsibility to keep a business register

- the responsibility to pay unclaimed money to the Registrar.

An inactive and unpaid balance in a cashless wallet may comprise both ‘unclaimed money’ under the Unclaimed Money Act 2008 as well as ‘unclaimed winnings’ under the Act. Cashless gaming systems are required to distinguish between these two amounts to assist venue operators in meeting their obligations under both these Acts.

2.3 Gaming reconciliations

Gaming data reconciliation periods

A venue operator must, at a minimum, perform the following reconciliations of data reported by gaming machines, to the data polled and reported by the monitoring system and a cashless system:

Daily data reconciliations

- Soft meter gaming data, independently recorded by the venue operator from each gaming machine, must be reconciled to gaming data polled and reported by the monitoring system.

- Verification that all tickets redeemed and paid have been effectively cleared on the monitoring system or the TITO system.

- Where possible, review and clear all machine exceptions raised by the monitoring system.

- Monitor the movement in all linked jackpot pools operating within the venue, including assessing the accuracy of jackpot contributions reported and reconciling reported jackpot wins to actual wins paid.

Weekly data reconciliations

- Implement required procedures to ensure that gaming tax obligations are managed, and a minimum amount of gaming revenue is being maintained in the nominated gaming account to meet the venue’s tax liability.

- Where possible, review and clear all machine exceptions raised by the monitoring system.

Monthly data reconciliations

- Complete a tax settlement reconciliation to verify the completeness and accuracy of amounts due and payable, as determined by the monitoring licensee.

- Monitor adherence to the minimum return to players requirement for gaming machines.

- Review and clear all machine exceptions raised by the monitoring system.

Each of the above reconciliation requirements have been outlined in detail in other sections of this document.

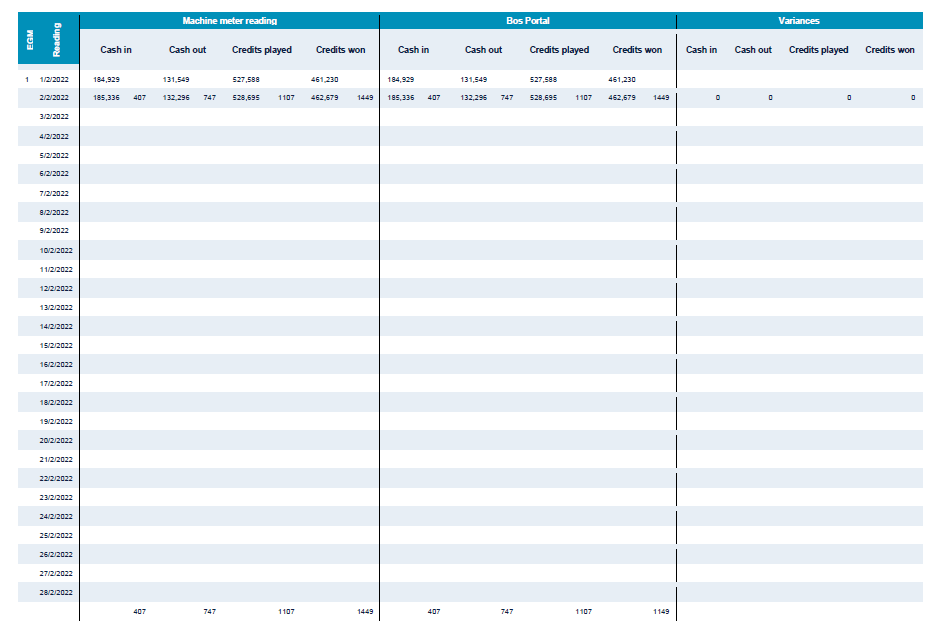

Metered vs polled data

A comparison of the independently recorded gross soft meter data and polled data provided by the monitoring licensee must be performed daily by the venue operator.

Metered data represents the financial gaming data calculated via the movements in the gross soft meters recorded independently by the venue from each of its gaming machines.

Polled data represents the financial gaming data reported by the monitoring system. The monitoring system will provide the venue operator with access to various polled data reports, including the Daily Gross Meters and Daily Venue Accounting Reports, which will provide the required data to perform this reconciliation.

At a minimum, the following metered data must be compared to the polled data reported by the monitoring licensee:

- turnover/credits played

- credits won

- cash in (total or individual meters that make up total cash in)

- cash out (total or individual meters that make up total cash out).

A venue operator must investigate any material discrepancy reported in the above reconciliation. Any material and unexplained discrepancies should be discussed with the monitoring licensee.

Appendix 1 provides an example of a suggested schedule to be used by the venue operator to ensure adherence to the soft meter recording requirement.

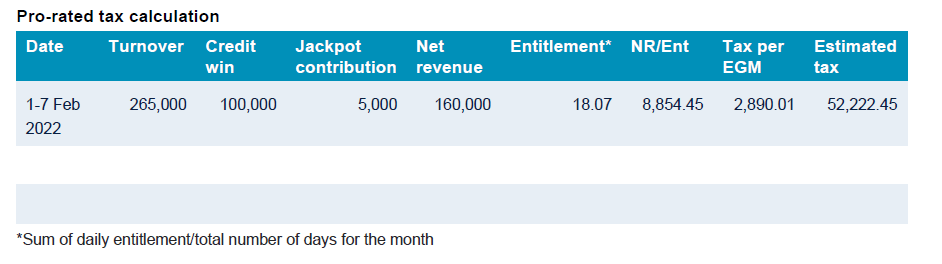

Minimum banking requirements

A venue operator must have processes and procedures in place to monitor the adequacy of amounts in the nominated gaming account to ensure a minimum level of banking is maintained to cover the expected tax liability at the conclusion of the month.

Recommended procedures to help a gaming venue adhere to this requirement include applying the following at regular intervals throughout the month:

- calculating and depositing the projected gaming tax payable by applying a pro-rated tax calculation, or

- allocating a fixed percentage of gaming revenue to the nominated gaming account, which is expected to cover the projected gaming tax obligation, e.g., fixed 60% of revenue.

Amounts determined as minimum banking deposits must be maintained until after the payment of gaming taxes at the conclusion of the month.

Procedures implemented by gaming venues must ensure that sufficient funds are maintained in the nominated account to cover the sweep of gaming taxes. If a venue is required to deposit additional funds at the conclusion of the month to cover their tax obligation, it is assumed that the procedures utilised to maintain minimum banking levels are not sufficient. In this instance a venue must reassess its procedures to ensure adherence to this requirement.

As part of the periodic audits conducted, the Commission will assess the adequacy of processes and procedures undertaken by the gaming venue to protect the tax liability at the conclusion of the month. As a result, the venue operator must maintain documentation clearly outlining the processes and procedures undertaken and the reconciliations performed in adhering to this requirement.

Appendix 2 provides an example of a suggested schedule to be used by the venue operator to ensure adherence to the minimum banking requirement.

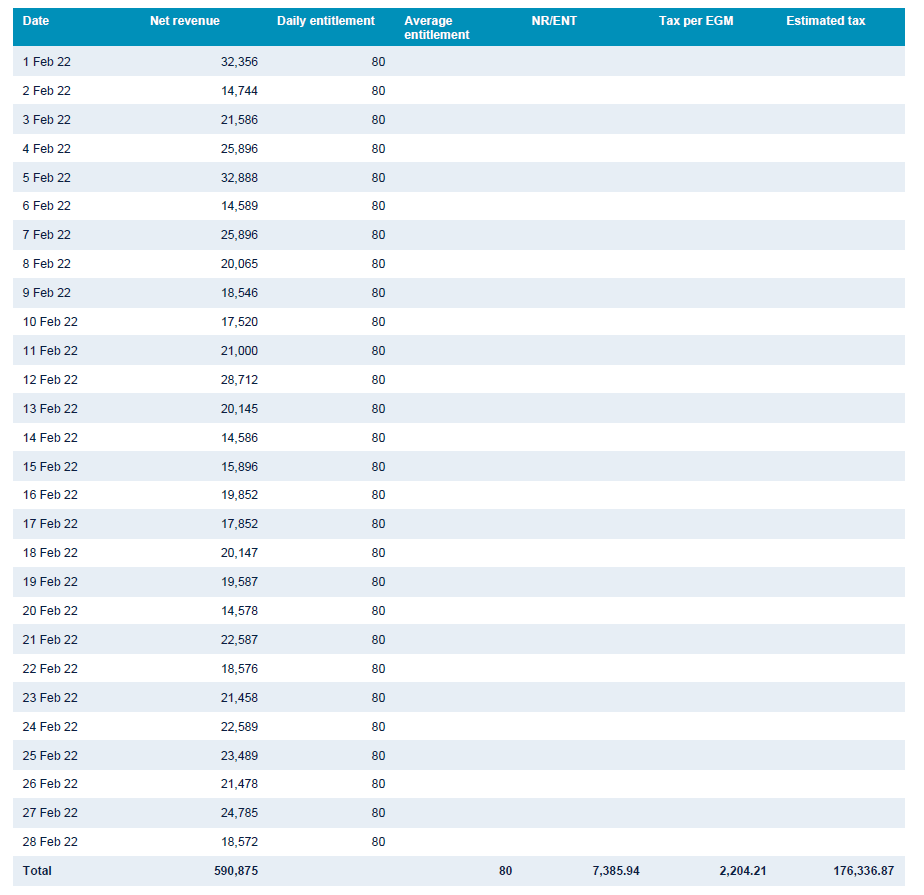

Tax settlement reconciliations

The monitoring licensee is responsible for the calculation of gaming taxes payable by each gaming venue. It will provide reports to the Commission and gaming venues that will detail the calculation and the amount of gaming taxes that will be swept from the venue operator’s nominated gaming bank account at the conclusion of the taxable month.

Upon receipt of the relevant gaming taxation report from the monitoring system a venue operator must perform an independent tax reconciliation to ensure the accuracy of the information provided on the report.

A venue operator should immediately address any issues with the monitoring licensee to ensure, where possible, any amendments to the tax calculation can be processed before the sweep is initiated.

Tax adjustments will be processed and applied to a subsequent tax period, if it is determined that a tax calculation performed by the monitoring system is incorrect and necessary adjustments could not be made in the same period.

The accuracy and completeness of the following components of the tax report should be verified by the venue operator as soon as possible:

- the average number of entitlements applied

- the net revenue or net cash balance

- the applied actual tax rate

- any financial adjustments processed, and

- the final tax to be remitted to the Commission.

A venue operator must maintain appropriate documentation clearly outlining the analysis performed to adhere to this requirement, which will be subject to review by the Commission.

Appendix 3 provides an example of a suggested schedule to be used by the venue operator to ensure adherence to the tax reconciliation requirement

Accounting discrepancy investigation

Any discrepancies identified via the above reconciliation processes must be investigated immediately by the venue operator.

Should the venue operator be unable to determine the cause of a discrepancy, the matter should be addressed with the monitoring licensee.

2.4 Cash/ticket handling and collection

A venue operator must maintain a separate gaming float of all monies used for its gaming transactions. The gaming float must be reconciled on a regular basis and provide for a sufficient level of control and verification of all movements of cash to and from this float.

A venue operator should enforce the following cash handling procedures:

- manually record movement of cash to and from the strong-room and gaming float

- cashier balancing and shift changeover procedures

- coin hopper refill and reconciliation procedures. An adequate level of documentation should be maintained to record all money movement to and from the hopper

- cash collection and storing procedures, including collection and storage of redeemed tickets from gaming machines, credit redemption terminals and the cashier station

- documenting procedures to follow up any identifiable variances, coin spillage, ticket destruction, or discrepancies

- signatory verification and adequate documentation for all monies moved within the gaming venue, in particular from the strong-room and gaming float, to and from gaming machines and between cashier shifts.

A venue operator must ensure that appropriate comparisons are made to ensure actual totals collected are accurate in comparison to expected totals. Immediate investigation must be conducted into any material variances that arise in this regard.

Maintaining cashless wallet balances

A venue operator must separately account for funds held in respect of cashless wallet balances, to ensure any or all patrons can withdraw the funds upon request. Records must be kept to monitor such amounts at all times and ensure player funds are maintained.

A venue operator must not allow a person to open more than one cashless wallet with the venue operator at the one time.

Any money that is held by a venue operator in a cashless wallet must—

- be kept separate from any other funds or accounts held or maintained by the venue operator,

- be stored in a bank account that is solely used for the purposes of managing cashless wallet balances, and

- not be used by the venue operator for any other purpose.

Such accounts and cashless wallet balances must be protected against forms of illicit access or removal.

Payment of tickets during system downtime

During periods of monitoring system downtime or TITO system downtime, tickets issued by such systems may be redeemed by patrons at the venue operator’s discretion, notwithstanding the inability to validate those tickets.

Manual records must be kept of any such redemptions, and the tickets must be validated and redeemed as soon as practicable after the relevant system is back online. Manual records should also be maintained to reflect the subsequent validation.

Any source documents used in the cash handling and collection procedures within a venue must be maintained in line with section 1.6 of these requirements.

2.5 Jackpot monitoring and reconciliations

Definitions

Linked jackpot arrangements (LJA): an arrangement under which a venue operator who holds a gaming machine entitlement may conduct gaming through 2 or more gaming machines that are linked to the same jackpot.

Multi Venue Linked Jackpot Arrangement: a linked jackpot arrangement linking gaming machines with other gaming machines in 2 or more approved venues.

Standalone jackpot machines (SJM): a gaming machine which offers an incrementing jackpot prize, which are funded and awarded based on the operation of the individual game and are not linked to any other gaming machines.

Jackpot special prize pool (JSPP): the pool of funds contributed to an LJA from the total amount wagered on gaming machines linked to the arrangement from which prizes won on the arrangement are paid.

Jackpot retirement: occurs when a jackpot arrangement ceases operation and is decommissioned from the monitoring system.

Jackpot signage: the value displayed on the signage above the gaming machines linked to the LJA. This is ordinarily the value of the start out, plus any signage increment.

Start out: the initial starting value of the jackpot prize. The signage pool is reset to the start out after each jackpot is triggered.

Jackpot contributions: Player contributions to LJAs which includes:

- signage increment: value of the jackpot contributions to the signage of the individual jackpot arrangement

- start out increment: value of jackpot contributions to fund the start out of the jackpot prize

- total increment: value of signage and start out increment.

Responsible Gambling Fund: the account established under section 19 of the Victorian Responsible Gambling Foundation Act 2011(opens in a new window).

Unpaid jackpot fund:

- in relation to a linked jackpot arrangement, means any funds remaining in a JSPP after all prizes won on the LJA have been paid; or

- in relation to a multiple venue LJA, means the proportion of surplus funds returned to the venue operator under the terms of the jackpot financial administration services agreement and the linked jackpot trust account established under section 3.4.49A of the Act in relation to the arrangement.

Jackpot operations

A venue operator must only operate approved machine and/or jackpot arrangements.

A venue operator must seek approval to operate a single venue LJA within the gaming venue.

A standalone jackpot is approved in line with the specific game approval which offers a standalone jackpot.

Monitoring linked jackpot arrangements

A venue operator must regularly monitor the operations of each LJA at the gaming venue.

Adequate supporting documentation must be maintained by the gaming venue to demonstrate adherence to the required processes regarding the monitoring of LJAs.

Monitoring the participation of machines in the LJA

A venue operator must ensure all gaming machines configured to be linked to the LJA are actively participating in the LJA at all times.

Each gaming machine configured to participate in an LJA must display the required signage indicating the gaming machine is actively participating in the LJA.

Failure to display the required signage on a gaming machine may indicate that the gaming machine has stopped participating in the LJA.

Any gaming machine that has stopped participating in an LJA must be investigated and rectified accordingly. The monitoring licensee or a venue operator's service provider should be contacted to correct any gaming machines not linked to a jackpot as required. If unable to immediately correct the issue, the gaming machine should be removed from game play mode or, alternatively, patrons must be informed that the gaming machine is not currently participating in the LJA, until the issue is corrected.

Monitoring the operation of the LJA in line with the approved conditions and the accuracy of information reported by the Monitoring Licensee

A venue operator must monitor the operation of each LJA, primarily the jackpot contributions and prizes won, to ensure the LJA is operating in line with the approved jackpot conditions and that information being reported by the monitoring licensee, in relation to the LJAs, is accurate and complete.

Monitoring an LJA’s operation will include an assessment of:

- jackpot contributions: the approved percentage of turnover that is contributed by each gaming machine participating in the jackpot and accumulated to the individual linked jackpot pool to fund the ultimate payment of jackpot prizes awarded under the LJA; and

- jackpot won: the value of the jackpot prizes awarded under the LJA.

To provide adequate supporting documentation for this requirement, a venue operator must provide:

- an independent calculation of daily jackpot contributions to the LJA in line with the approved jackpot conditions and the reported turnover of the linked gaming machines

- a comparison of the independently calculated jackpot contributions to the value of amounts reported by the monitoring licensee

- a review of the reported amounts, and where applicable, a reconciliation of reported jackpot won to actual wins paid.

Appendix 4 (table 1) suggests the structure of a report which can be used to verify the jackpot contribution and ensure adherence to associated requirements in this document.

Any discrepancies in relation to the above reconciliations should be immediately reported to the monitoring licensee for further investigation.

A venue operator must periodically bank verified jackpot contributions to a separate gaming bank account maintained solely for the operation of LJAs. These amounts should be monitored and used to pay linked jackpot prizes.

Monitoring the status of each LJA and its JSPP

A venue operator must monitor the status and the JSPP balance for each LJA.

This is to ensure its jackpot liability is managed, and adequate funds are available to pay jackpot prizes and any unpaid funds upon retirement of LJAs.

The balance of JSPP in relation to an LJA is the value of the total contribution less the total amounts paid out as jackpot prizes under each LJA, plus any JSPP carried forward from retired LJAs. The monitoring of retiring jackpot and jackpot carried forward will be further articulated in the next part of the section.

The monitoring of the JSPP must include:

- monitoring of the status and JSPP of each OPERATIONAL LJA

- accounting for the value of the balance of each RETIRED LJA

In monitoring the JSPP, a venue operator must, at a minimum, ensure that the contributions to and payment from an LJA are verified, in line with the above requirements, and required documentation of JSPP balance monitoring is maintained.

Appendix 4 (table 2) suggests the structure of a report which can be used to monitor the value of the JSPP.

The example report provided includes all the information which must be monitored and validated by the venue operator in relation to each LJA, including but not limited to the:

- name of each LJA

- start and end date (if applicable) of each LJA

- accumulated value of total jackpot contributions to each LJA (since inception)

- accumulated value of all jackpots won in relation to each LJA (since inception)

- accumulated value of all JSPP carried forward for each LJA (if applicable)

- balance of the JSPP in relation to each current LJA and the JSPP balance of the retired LJAs at the time of retirement

- the total value of the JSPP.

Retiring linked jackpot arrangements

A venue operator may retire an LJA as it deems necessary. However, it must consult with the monitoring licensee to ensure the required processes are followed.

Upon retiring an LJA, the venue operator must account for the JSPP balance of the retired LJA.

The monitoring licensee will facilitate the retiring and transfer of JSPP of LJAs to help with ensuring adherence to the conditions within this document.

The Commission will monitor the retiring of LJAs and ensure adherence to this document.

Dealing with unpaid jackpot funds on retirement of an existing jackpot

Section 3.5.44 of the Act states that:

- Subject to sections 3.5.45 and 3.5.46, if a venue operator retires a linked jackpot arrangement operating in an approved venue, the venue operator must—

- within 60 days, allocate the balance (whether in surplus or deficit) of the jackpot special prize pool in relation to that arrangement to the jackpot special prize pool in relation to another linked jackpot arrangement operating in the approved venue; or

- within 7 days after the end of that 60-day period, pay any unpaid jackpot funds to the Commission for payment into the Responsible Gambling Fund.

If the venue operator allocates the balance (whether in surplus or deficit) of the JSPP of retired LJA to another LJA operating at the approved venue, the JSPP balance will be carried forward and included in the calculation of the JSPP balance for another existing LJA.

Where the balance of the JSPP of the retired LJA is in surplus, the venue operator must also allocate the JSPP balance to the overflow pool of the LJA operating at the approved venue, to ensure that these unpaid funds are returned to the player

Appendix 4 (table 3) provides examples of different scenarios of the JSPP allocation when retiring an LJA.

Dealing with jackpot retired previously (before 10 March 2023)

Section 3.5.47 of the Act states that

- If a venue operator retired a linked jackpot arrangement before the commencement of this Division—

- the venue operator may, within 12 months after that commencement, allocate the balance (whether in surplus or deficit) of the jackpot special prize pool in relation to that arrangement to the jackpot special prize pool in relation to another linked jackpot arrangement operating in the approved venue; and

- within 7 days after the end of the period referred to in paragraph (a), the venue operator must pay any remaining unpaid jackpot funds in relation to the retired linked jackpot arrangement to the Commission for payment into the Responsible Gambling Fund.

- This section does not apply in relation to a linked jackpot arrangement that was retired before 16 August 2012.

If the venue operator allocates the balance (whether in surplus or deficit) of the JSPP of the retired LJA (before 10 March 2023) to LJA operating at the approved venue, the JSPP balance will be carried forward and included in the calculation of the JSPP balance for existing LJA.

Where the balance of the JSPP of the retired LJA (before 10 March 2023) is in surplus, the venue operator must also allocate the JSPP balance to the overflow pool of the LJA operating at the approved venue, to ensure that these unpaid funds are returned to the player.

Documentation must be maintained by the venue operator detailing its adherence to the above requirements, payment of amounts to the Commission for further payment into the RGF, and any discrepancies that have been investigated with the monitoring licensee.

The monitoring system will provide reports to assist venues in ongoing monitoring of the value of the JSPP and quantifying any unpaid amounts due and payable to remit any amounts in line with obligations under Division 7 of Part 5 of Chapter 3 of the Act.

Monitoring standalone jackpot machines

In relation to all SJMs in operation at a gaming venue, the venue operator must monitor the gaming machines to:

- ensure that all SJMs are operating within their approved parameters and conditions

- validate the accuracy and completeness of any data reported by the monitoring system in relation to the SJMs (if available).

Adequate supporting documentation must be maintained by the gaming venue to demonstrate adherence to the required processes regarding the monitoring of SJMs.

Resetting standalone jackpot machines

A SJM must only be master reset as a last resort to restore connection to the monitoring system, correct a fault or anomaly or as part of the commissioning process.

If a SJM is reset, the venue must instruct the technician to:

- reset the jackpot prize to its incremented value prior to the reset or

- where the above is not possible due to the machine type, reset the jackpot prize to the value nearest to the jackpot prize prior to the reset.

A venue operator must clearly account for its management of any standalone jackpot prizes upon removal/resetting of SJMs.

Retiring standalone jackpot machines

When retiring an SJM, the value of the standalone jackpot prize must be:

- transferred to another standalone jackpot prize on an SJM within the gaming venue; or

- if there is no SJM at the time of the retirement, the standalone jackpot prize must be transferred if another SJM is installed in the venue after the retirement.

The venue operator must retain accurate records showing the management of standalone jackpot prizes at the venue, and amounts transferred upon retirement of the jackpots. These records must be available to the Commission upon request and may be audited to ensure all amounts are accounted for as required.

The monitoring licensee will facilitate the retiring and transfer of standalone jackpot prizes. The Commission will monitor the retiring of jackpots and ensure adherence to this requirement.

Accounting for standalone jackpot machines

The venue must initiate processes to ensure adequate funds are available to pay standalone jackpot prizes. Documentation should be maintained to provide evidence of meeting this requirement.

3. Gaming taxes

3.1 Calculation of gaming tax

A venue operator is responsible for remitting gaming taxes on a monthly basis to the Commission.

The Commission will perform a direct sweep of gaming taxes on a monthly basis from the venue’s nominated gaming bank account.

Sections 3.6.6C of the Act provide details of the relevant tax calculation applicable to pubs and clubs respectively.

The venue operator must pay to the Commission the monthly gaming tax calculated as follows:

| T = GMT x E |

| T = tax payable for a calendar month |

| GMT = tax per gaming machine entitlement |

| E = average number of gaming machine entitlements held by the venue operator during the month |

Further to the above table, the following should also be noted:

- Average number of gaming machine entitlements = Total gaming machine entitlements held at the venue for each day of the calendar month ÷ Number of days in that month.

- Average revenue per gaming machine entitlement = Total revenue earned at the venue during the month ÷ Average number of gaming machine entitlements.

- Tax per gaming machine entitlement = Average revenue per gaming machine entitlement x Applicable tax rate.

3.2 Components of the tax calculation

Net cash balance

Net cash balance is calculated as follows:

- Net cash balance = Turnover - Credits won - Jackpot contributions.

- Turnover = Value of bets placed on a gaming machine.

- Credits won = Amounts returned to players as prizes.

- Jackpot contributions = Amounts contributed to a jackpot special prize pool to be paid as jackpot special prizes.

Entitlements for taxation purposes

An entitlement for the purposes of gaming taxation is an entitlement that is attached to:

- a gaming machine

- a venue approval

- the monitoring system of the monitoring licensee.

Therefore, in order for an entitlement to be used for taxation as an entitlement under which gaming is or may be conducted, each of the three criteria identified above must be evident.

Section 3.3 of these requirements provides examples of the tax calculation that outline the application of this section.

Average number of gaming machine entitlements

The average number of gaming machine entitlements means the sum of the total number of gaming machine entitlements under which gaming is, or may be, conducted at the approved venue on each day of a calendar month divided by the number of days in that month.

The number of days in the calendar month will always be applied to the taxation calculation for all venues, other than the initial month and the concluding month of the gaming licence. In these months, the tax calculation will only be applied to the number of days under which the calculation applies, i.e., for a partial month of gaming trade; the tax calculation will be applied to the number of days in the month under which gaming was conducted at the approved venue.

If the amount results in a total number that is not a whole number, the total number will be rounded up to the next 2 decimal places.

Average revenue per gaming machine entitlement

The average revenue per gaming machine entitlement means revenue earned by a venue operator in a calendar month under the gaming machine entitlements, calculated on the following basis:

Monthly net cash balance ÷ Average Number of gaming machine entitlements

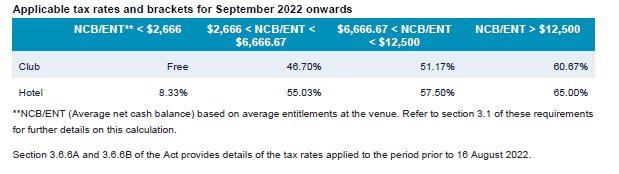

Gaming tax rates

Gaming tax is calculated using the following progressive tax rates, which came into effect on 16 August 2022, based on average monthly net cash balance, per machine, per venue.

3.3 Examples of the tax calculation

Example 1

Club Simple Inc has:

- approval to operate 100 gaming machines at Club Simple

- purchased 100 entitlements

- purchased 100 gaming machines

- 100 gaming machines connected to the monitoring system.

If Club Simple generates $2,000,000 in revenue for the calendar month of September 2022, the tax liability for that month is calculated as follows:

- Average revenue per gaming machine entitlement: $2,000,000 ÷ 100 = $20,000

- Tax per entitlement: ($6,666.67 - $2,666) x 46.7% + ($12,500 - $6,666.67) x 51.17% + ($20,000 - $12,500) x 60.67% = $9,403.48

- Total tax liability for a calendar month: $9,403.48 x 100 = $940,348

Example 2

Pub Simple Pty Ltd has:

- approval to operate 100 gaming machines at Pub Simple

- purchased 100 entitlements

- purchased 100 gaming machines

- 100 gaming machines connected to the monitoring system.

If Pub Simple generates $2,000,000 in revenue for the calendar month of September 2022, the tax liability for that month is calculated as follows:

- Average revenue per gaming machine entitlement: $2,000,000 ÷ 100 = $20,000

- Tax per entitlement: ($2,666 x 8.33%) + ($6,666.67 - $2,666) x 55.03% + ($12,500 - $6,666.67) x 57.5% + ($20,000 - $12,500) x 65% = $10,652.81

- Total tax liability for a calendar month: $10,652.81 x 100 = $1,065,281

Example 3

Club Alpha is conducting gaming from 7 September 2022 and has:

- approval to operate 50 gaming machines at its venue

- purchased 50 entitlements at the gaming auction

- purchased 40 physical gaming machines, and

- 40 gaming machines connected to the monitoring system and operational from 7 September to 30 September 2022.

The calculation of gaming tax for the month requires the use of the average number of gaming machine entitlements. This is based on the number of gaming machine entitlements that is, or may be used, in the conduct of gaming at the approved venue.

In the month of September 2022, Club Alpha’s calculation of average entitlements is:

- 40 entitlements x 24 days in September = 960

- 960 ÷ 30 days = 32 average entitlements

Example 4

John Jones is a venue operator who has two venues as following:

- Venue 123 – approval to operate 50 gaming machines

- Venue 456 – approval to operate 50 gaming machines

John Jones has purchased 100 entitlements and 80 gaming machines.

Forty gaming machines are allocated for operation in Venue 123 and 40 gaming machines are allocated to operate in Venue 456. All 40 machines are attached to each venue and are operating from 16 October to 31 October 2022.

Gaming tax is calculated on the basis of the gaming revenue and average entitlements at each individual venue.

John Jones is liable to pay separate gaming tax for each of Venue 123 and 456.

Gaming tax will be withdrawn from the nominated bank account of each gaming venue on the seventh day after the end of the month to which the tax relates. The nominated gaming account may be the same for both venues owned by John Jones.

At each venue, the calculation of gaming tax will be based on 40 entitlements, which are attached to 40 gaming machines connected to the monitoring system and operating at the approved venue and therefore are, or may be used, to conduct gaming.

3.4 Payment of gaming taxes

The Commission will sweep the calculated taxes from venue’s nominated gaming bank accounts (authorised by venues by their completed DDA (refer section 1.8 of these requirements)). The tax payable will be swept from the nominated gaming bank accounts on the seventh day, or the next business day, after the conclusion of the calendar month.

The tax payable, as advised by the monitoring licensee and verified by the venue operator, must be readily available to be swept from the nominated gaming bank account on the seventh day after the conclusion of the month to which the taxes relate.

The Commission will not collect any taxes if the full amount, as notified by the monitoring licensee, is not available for sweeping on the seventh day after the conclusion of the month.

Part payment of taxes due to insufficient funds in a nominated gaming account will not be accepted and enforcement action will be taken for such non-compliance.

Proceedings will be initiated by the Commission to collect outstanding gaming taxes that are not remitted when due and payable. Penalties will be applied accordingly to such amounts.

Should the Commission be unable to initiate the tax sweep in line with the above condition, appropriate directions will be provided to gaming venues to remit required taxes outside the sweep process.

3.5 Provision of tax remittance to be collected

On the fifth day following the conclusion of the taxable month, the monitoring licensee will provide the Commission and the venue operator with details of the gaming taxes to be remitted by each gaming venue. The gaming venue will be required to assess the required report from the monitoring system.

Upon accessing the required report from the monitoring system, the venue operator must ensure that sufficient funds are available in the nominated account to be swept by the Commission on the seventh day of the month.

The Commission will sweep the gaming taxes as detailed in the monthly taxation report provided by the monitoring licensee.

3.6 Penalties on late payment

Section 3.6.10 of the Act requires that if an amount payable to the Commission by a venue operator that holds a gaming machine entitlement is not paid within the period within which it is required to be paid, the venue operator is liable to pay interest at the rate of 20% per annum on that amount from the date on which the payment was due until the payment is made.

The Commission will provide written advice to the gaming venue should it be liable to pay penalty interest associated with late payment of taxes or incomplete calculation of taxes due to the venue’s failure to process gaming machine meter exception adjustments in a timely manner.

Continual non-payment of taxes may result in disciplinary action being taken by the Commission, meaning the possibility of:

- cancellation or suspension of the venue operator licence

- variation of the conditions of the venue operator licence

- issuing of a letter of censure to the venue operator

- imposition of a fine not exceeding 5000 times the value of a penalty unit.

4. Other gaming audit requirements

4.1 Minimum return to players

Section 3.6.1 of the Act requires that:

- a gaming operator or a venue operator who holds a gaming machine entitlement must ensure that the pay-out table on gaming machines at each venue is set so as to return to players the players' proportion of the total amounts wagered each year at that venue, after deduction of the sum of jackpot special prizes determined as prescribed and payable during that year.

- the players’ proportion is not less than 85%.

It is the responsibility of the venue operator to have adequate procedures and periodic reconciliation in place to ensure that the above section of the Act is adhered to by the conclusion of the calendar year. Furthermore, as required by the Act, only variations of games with their specified payout tables approved by the Commission are to be conducted on gaming machines.

Action must be taken by the venue, prior to the end of the year, to ensure that the total return from all attached gaming machines within the venue return the prescribed amount to the players.'

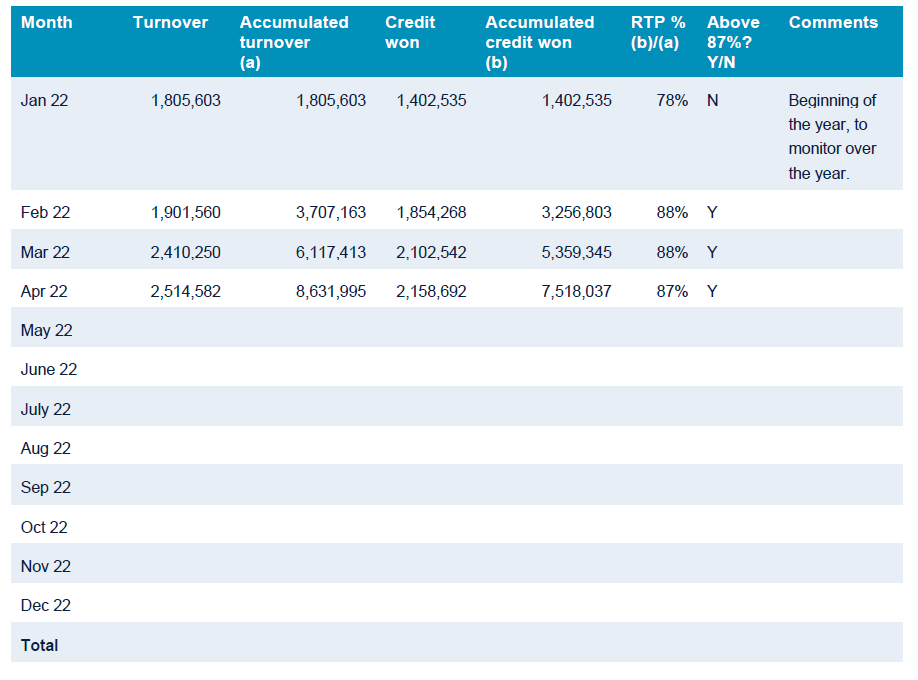

Appendix 5 provides an example of a suggested schedule to be used by the venue operator to ensure adherence to the minimum return to players requirement.

4.2 Supervision of the gaming machine area

In line with rule 4 of the Victorian Commission for Gambling Regulation Rules, a venue operator must ensure that the operation of the gaming machine area and each gaming machine is subject to continual supervision. Supervision must be electronic, physical or a combination of both.

Constant supervision of all areas within the gaming machine area, in particular the operation of each gaming machine, cashier terminal and credit redemption terminal, will provide a tool to enable venue operators and the Commission to identify a person tampering with or attempting to tamper with gaming equipment; and to aid in resolving patron disputes.

Electronic (CCTV) security requirements

To ensure compliance with the rules, in relation to a venue’s gaming machine area, the CCTV system must:

- record continuously (defined as without interruption, i.e., not motion detection) – 24 hours a day, 7 days a week

- record at a minimum rate of 6 frames per second

- have auto-embedded time, date, and camera ID on all pictures

- store images at an adequate resolution and picture quality to enable the identification of an individual, at all entrances and exits and at the cashier station and within the gaming machine area, and the identification of each gaming machine

- retain recorded images of the gaming machine area for a minimum of 28 days, unless the venue’s liquor licence or other regulatory requirement specifies a greater length of retention, in which case the greater length of retention applies. Should any complaint or investigation occur before destruction of recorded images, relevant images must be retained until the issue has been resolved.

Physical supervision

A licensed gaming industry employee (GIE) must be on hand to conduct prescribed duties as defined in part 7 of the Gambling Regulations 2015. Such duties include:

- any task that requires access to the logic area of a gaming machine

- possessing keys that unlock the logic area of a gaming machine

- issuing logic keys to another person holding a GIE licence

- supervising persons carrying out the above duties at an approved venue

- performing any task that requires access to any a jackpot interface board (JIB) or EGM interface board within a gaming machine.

To adhere to the above regulation, at least one licensed GIE must be on duty at all times to assist, supervise and perform prescribed duties.

Notwithstanding this minimum GIE staffing requirement, venue operators are expected to ensure that staffing levels within a gaming machine area are adequate to ensure all legislative requirements associated with the proper supervision and conduct of gaming are able to be met.

4.3 Appropriate documentation to support adherence to requirement

A venue operator must maintain documentation to ensure adherence to all sections of these Accounting and Auditing Venue Requirements and in a manner that can be audited by the Commission.

Documentation will be reviewed periodically by the Commission and appropriate recommendations will be made to the venue operator if the documentation maintained does not allow for efficient and effective auditing practices.

If a venue operator does not take appropriate action to rectify their practices as required by the Commission, disciplinary action may be taken against the venue operator.

4.4 Gaming room hours of operation

A venue operator must ensure its gaming room hours of operation comply with all requirements, including, but not limited to:

- Section 3.5.22 of the Act which states that a person must not play a gaming machine in an approved venue at any time when the approved venue is closed to the public

- Section 3.5.28A of the Act, which prohibits the playing of a gaming machine between 4:00 a.m. and 10:00 a.m. on any day

- Part 2, 3(1) of the Victorian Gambling and Casino Control Commission (VGCCC) Rules, made pursuant to section 3.5.23(1) of the Act, which states that a venue operator may offer gaming to a person only during the period or periods when a licence is granted under the Liquor Control Reform Act 1998 where the premises authorises the consumption on those premises of liquor supplied on those premises.

To allow for adequate monitoring of a venues gaming room hours of operation, a venue operator must:

- specify their gaming room’s hours of operation via facilities made available by the Monitoring Licensee’s monitoring system (nominated gaming hours)

- ensure that any changes to the gaming room’s hours of operation only be activated after the details of those changes have been successfully submitted via facilities made available by the Monitoring Licensee’s monitoring system, and

- ensure no gaming occurs outside of the nominated gaming hours and mandatory closure periods.

The Monitoring Licensee will provide further instructions in relation to submission of the nominated gaming hours, including time periods by which changes must be submitted before they take effect in the monitoring system.

A venue operator must ensure they comply with such conditions to ensure they remain compliant with this requirement.

A venue operator has discretion in relation to setting and varying their venues nominated gaming hours, however they must ensure their nominated gaming hours meet all legislative requirements and any other conditions of operation.

4.5 Malfunction of gaming machines

As required under section 3.5.20 of the Act, a venue operator must ensure that it does not pay, or allow payment to be made to, a person in respect of a bet made or gaming machine credits accumulated on a gaming machine if the operator or employee reasonably suspects that the gaming machine or any related gaming equipment failed to function in the manner in which it was designed and programmed to function.

In the event of a dispute over a refusal to pay in the circumstances referred to above, the entitlement holder must resolve the dispute in accordance with procedures approved by the Commission.

4.6 Patron dispute procedures

Under section 3.5.23 of the Act, the Commission may make rules for or with respect to procedures for the resolution of disputes concerning payment of winnings from gaming in an approved venue.

The Commission approved dispute resolution procedures are available in the VGCCC Venue Manual (Venue operational requirements chapter). For a copy of this manual, please email: contact@vgccc.vic.gov.au.

Section 5.4 contains information regarding patron disputes and includes links to the approved dispute resolution procedures and templates for:

- patron dispute form

- game play recall information form

- suspected malfunction of a gaming machine form.

A venue must ensure it retains all information pursuant to a patron complaint to facilitate a further investigation that may be required to be conducted by the VGCCC. To assist any investigation a venue must retain a copy of the VGCCC approved patron dispute forms, any internal documentation and any supporting material in relation to the dispute. Supporting material must include, but is not limited to, any recorded evidence of the instance such as CCTV footage, a screen shot/s or video footage of machine or recalled game plays subject to the complaint, etc.

4.7 Credit betting

As required under section 3.5.31 of the Act, a venue operator must not loan, or extend credit in any form, to any person to enable that person or any other person to play a gaming machine in an approved venue and ensure their staff do not do so.

4.8 Provision of gaming data for audit purposes

Data recording and reconciliations must be completed by the venue operator in a timely manner and be readily available for provision to the Commission as required.

Penalties may apply for the failure to provide necessary data as required by the Commission to complete its audit functions.

4.9 Dealing with unexplained variances

A venue operator must address any unexplained variances in a timely manner and maintain appropriate documentation for all variances detected and investigations or further enquiries conducted.

Appropriate bodies to help with unexplained variances may be:

- the monitoring licensee: to provide assistance regarding the operating system used at the gaming venues and any issues with the use of the system and the gaming data reported by it

- a third-party service provider (if applicable): issues regarding the operations of the gaming venue should be addressed via this channel

- an industry professional: advice from professional bodies such as accountants and auditors should be immediately sought in the event of cash handling discrepancies and of other financial issues at the gaming venue

- the Commission: any regulatory issues regarding compliance should be addressed with the Commission.

Appendix 1

Soft meter recording and reconciliation

A comparison of the independently recorded gross soft meter data and polled data provided by the monitoring licensee must be performed daily by the venue operator.

Metered data represents the financial gaming data calculated via the movements in the gross soft meters recorded independent by the venue from each of its gaming machines.

Polled data represents the financial gaming data reported by the monitoring system. The monitoring system will provide the venue operator with access to various polled data reports, including the Daily Gross Meters and Daily Venue Accounting Reports, which will provide the required data to perform this reconciliation.

At a minimum, the following metered data must be compared to the polled data reported by the monitoring licensee:

- turnover/credits played

- credit wins

- cash in (total or individual meters that make up total cash in)

- cash out (total or individual meters that make up total cash in).

Appendix 2

Minimum banking requirements

A venue operator must have procedures in place to monitor the adequacy of amounts in the nominated gaming account to ensure a minimum level of banking is maintained to cover the expected tax liability at the conclusion of the month.

Recommended procedures to assist a gaming venue in ensuring adherence to this requirement include applying the following at regular intervals through the month:

- Calculating and depositing the projected gaming tax payable by applying a pro-rated tax calculation or

- Allocating a fixed percentage of gaming revenue to the nominated gaming account, which is expected to cover the projected gaming tax obligation, e.g., fixed 60% of revenue.

Amounts determined as minimum banking deposits must be maintained until after the payment of gaming taxes at the conclusion of the month.

Appendix 3

Tax settlement reconciliation

The accuracy and completeness of the following components of the tax report should be verified by the venue operator as soon as possible:

- the average number of entitlements applied

- the net revenue or net cash balance

- the applied actual tax rate

- any financial adjustments processed

- the final tax to be remitted to the Commission.

Appendix 4

Suggested linked jackpot arrangement monitoring tools

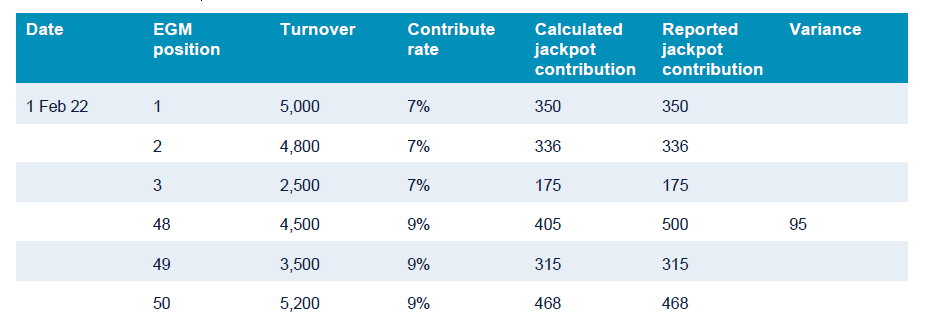

Table 1: Jackpot contribution verification

Suggested table to help validate jackpot contributions being dedicated from gaming revenue and accumulated to individual jackpot pools.

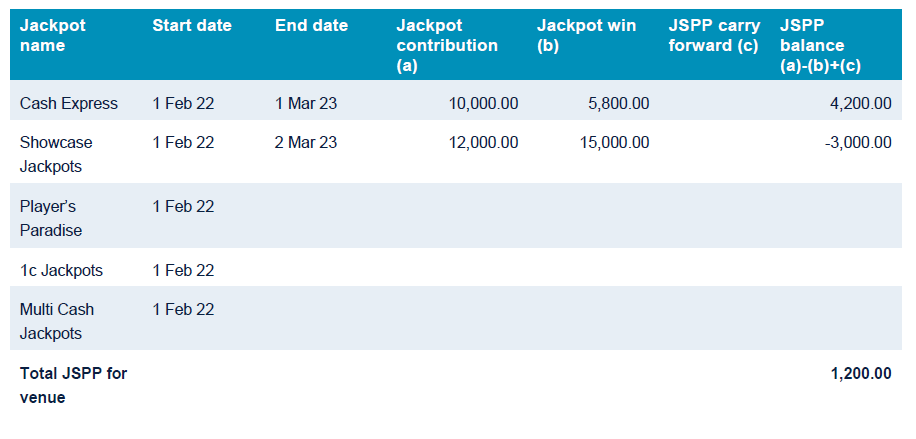

Table 2: Jackpot special prize pool monitoring

Suggested table to help monitor the value of the jackpot special prize pool across the venue.

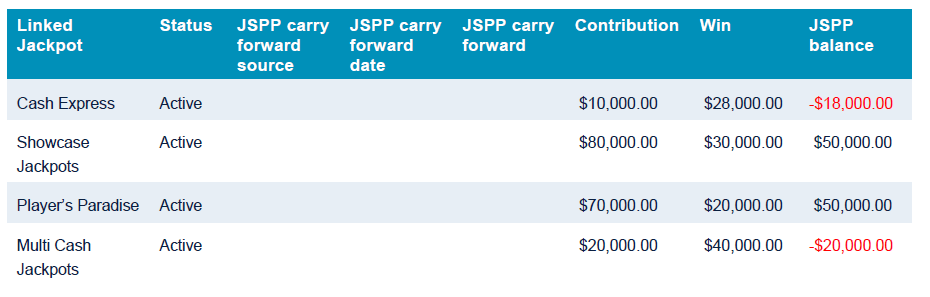

Table 3: Different scenarios of JSPP allocation when retiring an LJA

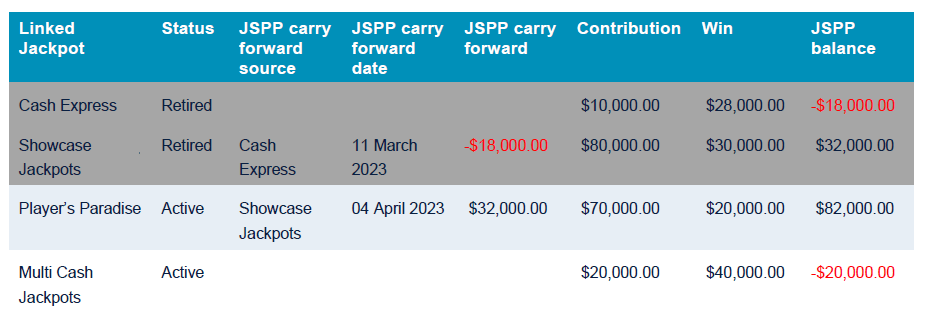

Base Scenario – Prior to Jackpot Retirement

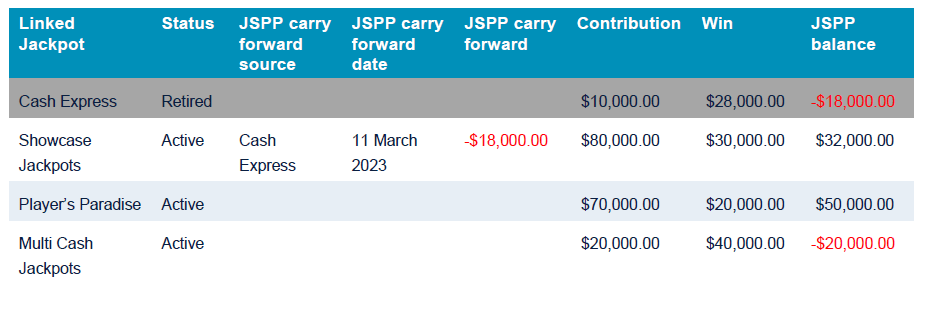

Case 1 Retired Cash Express – 11 March 2023

Venue decides to retire Cash Express and transfer the balance to Showcase Jackpots

Case 2 – Retire Showcase Jackpots - 04 April 2023

Venue decides to retire Showcase Jackpots and transfer balance to Player’s Paradise.

Note: to comply with the Act the venue operator must also allocate the positive JSPP balance to the overflow pool of the Player’s Paradise jackpot to ensure that the unpaid funds are returned to the player.

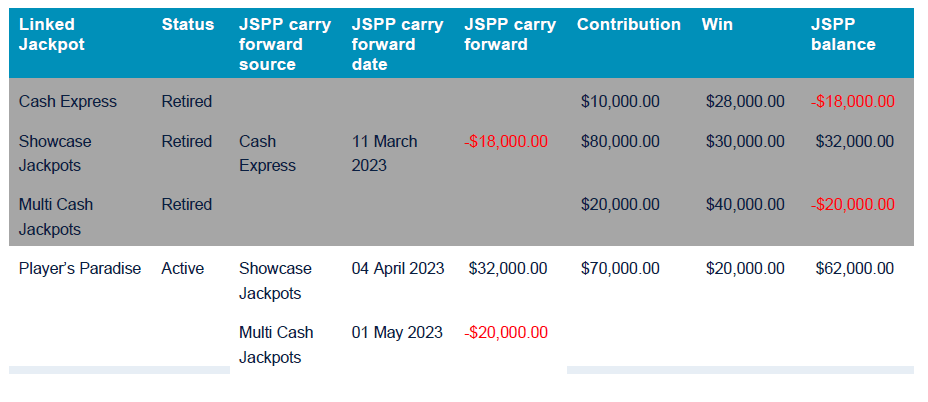

Case 3 – Retire Multi Cash Jackpots - 01 May 202

Venue decides to retire Multi Cash Jackpots and transfer balance to Player’s Paradise

Appendix 5

Minimum return to players

Section 3.6.1 of the Act requires that:

- a gaming operator or a venue operator who holds a gaming machine entitlement must ensure that the payout table on gaming machines at each venue is set so as to return to players the players’ proportion of the total amounts wagered each year at that venue, after deduction of the sum of jackpot special prizes determined as prescribed and payable during that year

- the players’ proportion is not less than 85%.

It is the responsibility of the venue operator to have adequate procedures and periodic reconciliation in place to ensure that the above section of the Act is adhered to by the conclusion of the calendar year.

Action must be taken by the venue, prior to the end of the year, to ensure that the total return from all attached gaming machines within the venue return the prescribed amounts to the players.

Recently, the Minister for Casino, Gaming and Liquor Regulation determined the standard entitlement related conditions.